All Categories

Featured

Table of Contents

- – Top Accredited Investor Property Investment Deals

- – Real Estate Investments For Accredited Investors

- – Exceptional Accredited Investor Growth Opport...

- – Superior Accredited Investor Opportunities

- – Leading Private Placements For Accredited In...

- – Sought-After Accredited Investor Real Estate...

- – Unparalleled Accredited Investor Crowdfundin...

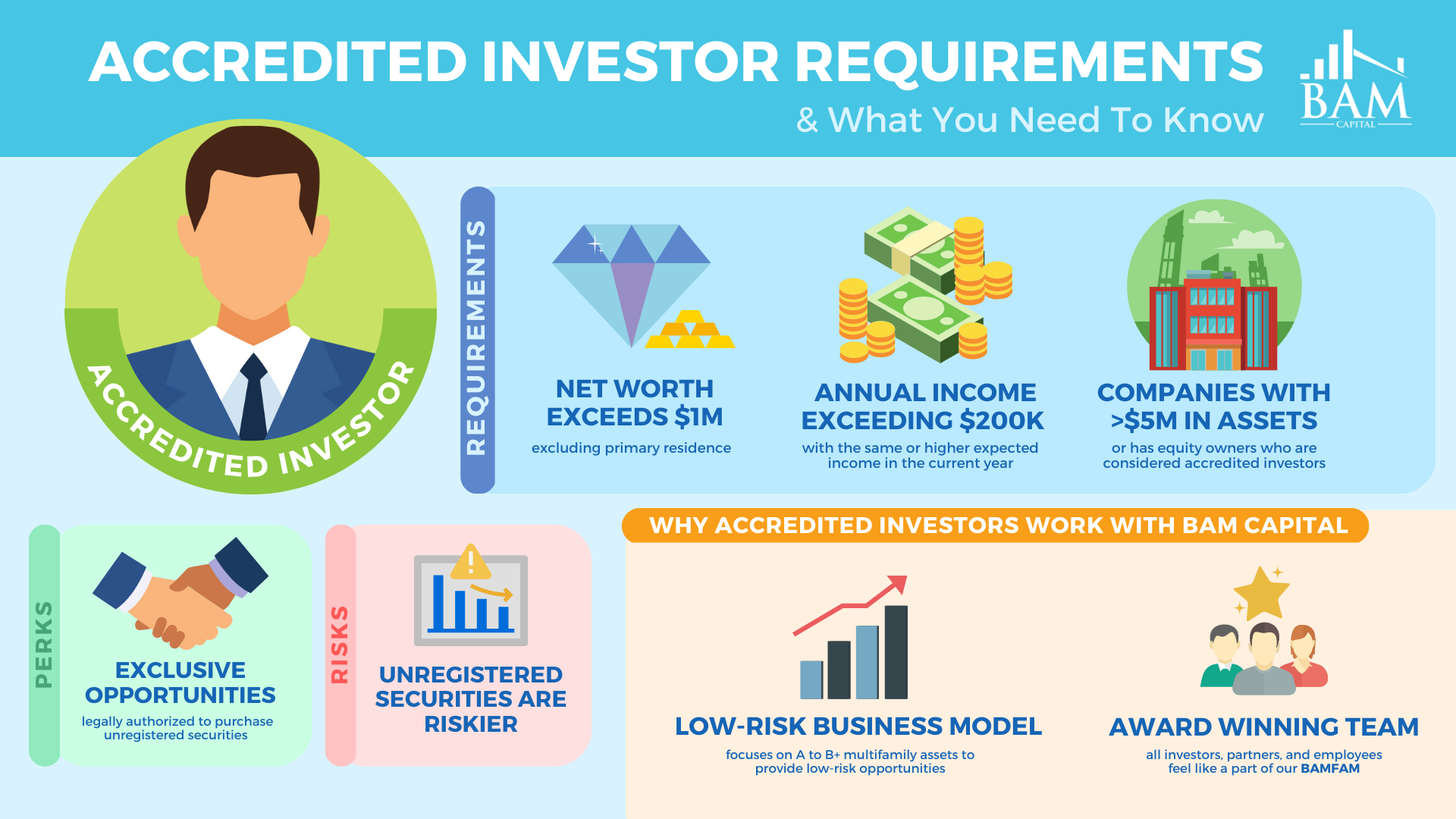

The policies for recognized investors vary among territories. In the U.S, the meaning of a certified financier is put forth by the SEC in Regulation 501 of Regulation D. To be an accredited capitalist, an individual must have an annual earnings going beyond $200,000 ($300,000 for joint income) for the last 2 years with the assumption of making the exact same or a greater earnings in the current year.

A certified financier ought to have a total assets surpassing $1 million, either individually or collectively with a partner. This amount can not consist of a main residence. The SEC also thinks about applicants to be recognized capitalists if they are general partners, executive officers, or directors of a firm that is providing unregistered protections.

Top Accredited Investor Property Investment Deals

Likewise, if an entity contains equity owners who are approved capitalists, the entity itself is a certified financier. However, an organization can not be created with the sole function of buying certain safeties - top investment platforms for accredited investors. A person can certify as a recognized investor by showing enough education or job experience in the economic sector

People who want to be certified capitalists do not apply to the SEC for the designation. Rather, it is the duty of the company offering a private positioning to make certain that all of those approached are certified capitalists. People or parties that wish to be certified capitalists can approach the provider of the unregistered safety and securities.

Expect there is a private whose income was $150,000 for the last 3 years. They reported a key house worth of $1 million (with a home mortgage of $200,000), an automobile worth $100,000 (with an exceptional funding of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Total assets is computed as possessions minus liabilities. He or she's internet worth is exactly $1 million. This involves a calculation of their possessions (besides their primary house) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan equaling $50,000. Since they meet the total assets need, they qualify to be an accredited investor.

Real Estate Investments For Accredited Investors

There are a couple of less common credentials, such as taking care of a depend on with more than $5 million in assets. Under government securities laws, only those who are certified financiers might take part in particular safety and securities offerings. These may include shares in private positionings, structured products, and personal equity or bush funds, among others.

The regulators intend to be particular that individuals in these highly high-risk and complex financial investments can look after themselves and judge the dangers in the lack of government protection. The recognized investor rules are developed to protect prospective financiers with limited monetary understanding from adventures and losses they might be sick geared up to endure.

Recognized investors fulfill credentials and expert standards to gain access to unique financial investment possibilities. Designated by the United State Securities and Exchange Compensation (SEC), they acquire access to high-return choices such as hedge funds, endeavor capital, and private equity. These financial investments bypass full SEC enrollment but bring greater risks. Recognized financiers should meet revenue and net well worth demands, unlike non-accredited people, and can spend without constraints.

Exceptional Accredited Investor Growth Opportunities for Accredited Wealth Opportunities

Some key modifications made in 2020 by the SEC include:. Including the Collection 7 Series 65, and Series 82 licenses or other credentials that reveal financial competence. This modification identifies that these entity types are typically made use of for making financial investments. This change recognizes the know-how that these staff members create.

This change represent the effects of inflation with time. These modifications expand the certified investor swimming pool by roughly 64 million Americans. This bigger access offers extra opportunities for investors, but additionally increases prospective risks as less monetarily innovative, financiers can take part. Organizations making use of private offerings may gain from a larger pool of possible investors.

One major advantage is the chance to purchase placements and hedge funds. These financial investment options are unique to certified investors and organizations that certify as an accredited, per SEC laws. Exclusive placements allow business to protect funds without browsing the IPO treatment and governing documents needed for offerings. This offers accredited investors the possibility to purchase emerging firms at a phase before they consider going public.

Superior Accredited Investor Opportunities

They are checked out as financial investments and are obtainable just, to certified customers. In addition to recognized business, qualified investors can pick to purchase start-ups and promising ventures. This supplies them tax returns and the possibility to go into at an earlier phase and possibly gain rewards if the firm flourishes.

Nevertheless, for investors open up to the threats entailed, backing startups can cause gains. A number of today's tech business such as Facebook, Uber and Airbnb stemmed as early-stage startups supported by accredited angel investors. Innovative capitalists have the possibility to explore investment choices that may produce a lot more earnings than what public markets supply

Leading Private Placements For Accredited Investors

Returns are not guaranteed, diversity and portfolio enhancement alternatives are expanded for investors. By expanding their portfolios through these increased financial investment opportunities approved capitalists can boost their strategies and possibly achieve superior lasting returns with proper risk management. Skilled capitalists commonly come across financial investment choices that may not be quickly readily available to the basic financier.

Financial investment choices and protections used to accredited investors usually entail higher risks. For instance, personal equity, endeavor capital and bush funds typically focus on purchasing possessions that lug threat but can be sold off quickly for the possibility of higher returns on those risky investments. Researching prior to investing is crucial these in scenarios.

Lock up durations avoid investors from withdrawing funds for even more months and years on end. Financiers might struggle to accurately value private assets.

Sought-After Accredited Investor Real Estate Deals

This adjustment may expand recognized capitalist status to an array of individuals. Allowing companions in committed partnerships to incorporate their resources for common qualification as recognized investors.

Allowing people with specific expert qualifications, such as Collection 7 or CFA, to qualify as recognized financiers. This would certainly recognize financial sophistication. Creating extra requirements such as proof of economic proficiency or effectively completing an approved investor test. This can guarantee investors comprehend the dangers. Restricting or removing the key house from the net well worth calculation to reduce possibly filled with air evaluations of wide range.

On the other hand, it might additionally result in experienced capitalists assuming too much dangers that might not be appropriate for them. Existing recognized capitalists might face increased competitors for the ideal financial investment opportunities if the pool expands.

Unparalleled Accredited Investor Crowdfunding Opportunities

Those who are currently thought about certified financiers have to stay upgraded on any type of modifications to the standards and laws. Their eligibility could be based on alterations in the future. To keep their standing as accredited capitalists under a modified interpretation changes may be required in wealth monitoring methods. Businesses looking for certified financiers must remain watchful concerning these updates to guarantee they are bring in the ideal audience of financiers.

Table of Contents

- – Top Accredited Investor Property Investment Deals

- – Real Estate Investments For Accredited Investors

- – Exceptional Accredited Investor Growth Opport...

- – Superior Accredited Investor Opportunities

- – Leading Private Placements For Accredited In...

- – Sought-After Accredited Investor Real Estate...

- – Unparalleled Accredited Investor Crowdfundin...

Latest Posts

Claiming Foreclosure On Taxes

All-In-One Tax Sale Overages System Tax Sale Overage List

Tax Foreclosure Property Sales

More

Latest Posts

Claiming Foreclosure On Taxes

All-In-One Tax Sale Overages System Tax Sale Overage List

Tax Foreclosure Property Sales